Fixed Income: Making ground in ESG

Share

Demand for ESG Fixed Income exposure is soaring, with ETFs seeing a surge in AuM.

Fixed income has historically trailed equities in environmental, social and governance (ESG) investing. But things are changing fast. Of the €32bn that flowed into Europe UCITS fixed income ETFs in 2022, €21bn was collected by ESG funds, equating to 65% of total bond fund inflows1. Investors now have more options to invest sustainably in fixed income than ever before, and it doesn’t stop here.

A slow start, but catching up fast

Progress to integrate ESG considerations into bond portfolios has been relatively slow. Consider that the first equity ESG index was launched in 1990, yet the first ESG bond index did not appear until 2013. This comes down in part to engagement factors. Bondholders lack the voting rights of shareholders, encouraging the misconception that they have a limited ability to engage with and exert influence on companies.

But, over recent years, things have shifted and ESG has gained significant traction in the fixed income markets.

This comes on the back of a growing body of evidence suggesting that incorporating ESG analysis into fixed income investing can reduce idiosyncratic and portfolio risk and may contribute to more stable returns2.

Hence, asset managers have been working hard to develop solutions that integrate ESG into fixed income. ESG factors are playing a more important role in credit ratings, and bond investors are increasingly engaging directly with companies, holding them to account on ESG issues. Keen to attract ESG investors and gain inclusion to major ESG indices, bond issuers are now much more forthcoming with information.

Source: Amundi ETF/Bloomberg as of December 2022

Covid-19: A booster shot for ESG investing

Covid-19 acted as a catalyst for the adoption of ESG investing by shifting investor focus to sustainable finance. The crisis also highlighted the resilience and growth potential of ETFs. Amid the market volatility that followed the pandemic outbreak, ETFs proved themselves nimble and resilient. Bond ETFs, in particular, traded in large volumes, even in segments with dwindling liquidity. Their versatility was recognised by monetary authorities, including the Federal Reserve, Bank of England and the BIS, who highlighted ETFs’ role in price discovery, particularly within fixed income.

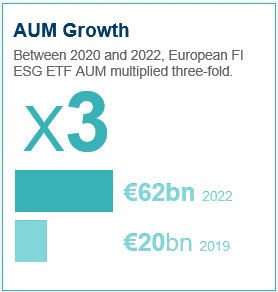

Demand for fixed income ESG ETFs has subsequently soared. Between 2020 and 2022, European fixed income ESG ETF assets under management multiplied three-fold, from €20 billion to over €60 billion1. Over the same period, the proportion of European fixed income ETFs incorporating ESG criteria has more than doubled from 10% to 24%1, giving investors even more options to invest sustainably.

ETFs: The vehicle of choice to implement ESG in fixed income

In our view, rising investor appetite for fixed income ESG ETFs will continue to drive product innovation and choice for investors, and we see great opportunities for fixed income to further grow its share of sustainable assets globally.

Tried and tested, ETFs are increasingly being embraced as the vehicle of choice to implement ESG fixed income in portfolios and we expect continued innovation and assets under management in these dynamic tools to surge. This should ultimately lead to greater choice for investors, enhancing their ability to incorporate sustainability in portfolios reflecting their investment beliefs and objectives.

1. Source: Amundi ETF / Bloomberg, March 2023

2. For example, ISS ESG in 2020 (https://www.pionline.com/esg/iss-study-links-esg-performance-profitability); McKinsey in 2019

Knowing your risk

It is important for potential investors to evaluate the risks described below and in the fund’s Key Investor Document (“KID”) and prospectus available on our website www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

Important information

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament (where relevant, as implemented into UK law) acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This material reflects the views and opinions of the individual authors at this date and in no way the official position or advices of any kind of these authors or of Amundi Asset Management nor any of its subsidiaries and thus does not engage the responsibility of Amundi Asset Management nor any of its subsidiaries nor of any of its officers or employees. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is explicitly stated that this document has not been prepared by reference to the regulatory requirements that seek to promote independent financial analysis. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Amundi Asset Management nor any of its subsidiaries accept liability, whether direct or indirect, that may result from using any information contained in this document or from any decision taken the basis of the information contained in this document. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFs. The Funds can either be denominated as “Amundi ETF” or “Lyxor ETF”. Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

For Amundi ETF:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

For Lyxor ETF:

- Multi Units France, French SICAV, RCS 441 298 163, located 91-93, boulevard Pasteur, 75015 Paris, France, managed by Amundi Asset Management

- Multi Units Luxembourg, RCS B115129 and Lyxor Index Fund, RCS B117500, both Luxembourg SICAV located 9, rue de Bitbourg, L-1273 Luxembourg, and managed by Amundi Asset Management

- Lyxor SICAV, Luxembourg SICAV, RCS B140772, located 5, Allée Scheffer, L-2520 Luxembourg, managed by Amundi Luxembourg S.A.

Before any subscriptions, the potential investor must read the offering documents (KID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs, and the KID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions and Lyxor SICAV), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPs, Multi Units Luxembourg, Multi Units France and Lyxor Index Fund). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi.